Authors

Dalton Sweeney

Summary and Motivation

The Warbler Team proposes making three key improvements to the Borrower Pool smart contracts.

- Which pools it affects: This will only affect net new pools from January 2023 onwards. There will be NO changes to any existing pools.

- Risk Management: The combination of these measures should help the Goldfinch community materially manage risk. More specifically:

- Credit Risk: Principal Amortization (summary below) will allow, but not oblige, pools to be stood up allowing Borrowers to distribute their principal payments over time (e.g. monthly, quarterly, half-yearly), vs waiting to make a single lump sum payment (i.e. very high risk event).

- Operational Risk: Daily Interest Accrual + Calendar Based Payment Schedules (summaries below) will make it easier for Borrowers to understand and more systematically track/manage their payment obligations, potentially reducing interest and principal payment issues due to operational confusion.

Daily Interest Accrual

This feature allows Borrowers to pay back interest accrued up to the current day. It fixes two problems with the current pools.

- If a Borrower pays a couple of days after the due time and includes the additional interest accrued in the payment, then the extra amount will pay down the balance instead of the interest. This has resulted in Borrowers unintentionally paying down their balance early.

- If a Borrower pays back all interest and principal early, the pool doesn’t process the payment until the payment period ends (even though the pool takes custody of the USDC). This results in interest accrued on capital the borrower has already given back.

Principal Amortization

This feature allows payment schedules with periodic principal payments, a material improvement in helping Goldfinch manage risk allowing Borrowers to pay down the principal over time. An example would be a one year loan where 25% of the principal is due every quarter. This expands upon the types of loans Goldfinch can offer. The current smart contracts only support bullet loans.

Calendar Based Payment Schedules

This feature enables payment due times to fall on calendar dates. Payments typically fall on the same date each month in the rest of the debt capital markets world. Current pools use a fixed number of days for each payment period. We can approximate a monthly schedule with fixed 30-day periods, but this causes due dates to drift (e.g. March 1st, March 31st, April 30th, …). This increases risk for Goldfinch as Borrowers have to constantly change the date they make payments on, resulting in operational errors driving late payments (e.g. confused when to pay).

Note that the example uses a monthly schedule because that’s the most common schedule type, but the new system will support arbitrary scheduling.

Specification and Requirements

Daily Interest Accrual

The key requirement is that interest accruing in the current payment period can be voluntarily paid before the period ends.

The payment waterfall is adjusted to support early interest payments. To explain the new payment waterfall we must define the following terms:

- interestAccrued: interest accrued after the most recently past due time that can be paid back early

- interestOwed: interest accrued up to the most recently past due time that hasn’t been paid yet (same meaning as the current smart contracts)

- principalOwed: principal owed since the most recently past due time (same meaning as the current smart contracts)

The new payment waterfall is shown below, with interestOwed having the highest priority

.

└── interestOwed

└── principalOwed

└── interestAccrued

└── remainingBalance

Principal Amortization

- Introduce the “principal grace period” concept. From the start of the loan until the end of the principal grace period, the borrower is not required to repay any principal.

- Payment periods outside of the principal grace period should split the remaining principal balance evenly among the remaining payments. For example: if there are six remaining payment periods and the borrower has a balance of $12, each period should require the borrower to pay back $2 + interest.

- After the principal grace period, the amount of money available for the borrower to drawdown should decrease evenly to 0 over the remaining payment periods.

- Interest and principal payments can have different schedules (e.g. monthly interest payments, quarterly principal payments)

Example

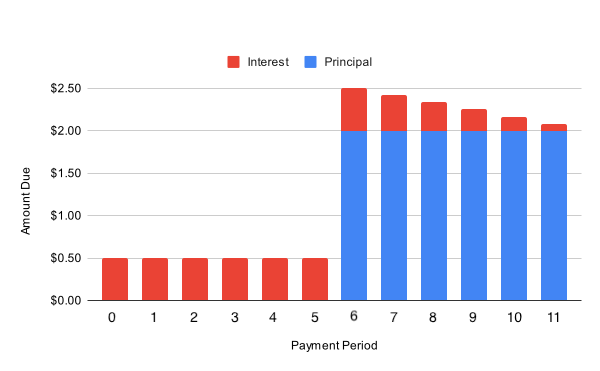

This example is a $12 loan with twelve payment periods. The interest and principal payments have the same schedule: once per payment period.

The principal grace period is six payment periods, so no principal is owed in the first six periods. Interest is owed every period, independent of the principal grace period.

After the principal grace period ends, the principal payments are spread evenly across the remaining six periods ($2 per period). The interest owed for subsequent periods decreases as the borrower pays back principal.

Calendar Based Payment Schedules

Borrower Pools can have schedules such that payments are due on arbitrary calendar dates, the most common being the first day of every month, or the first day of every quarter. Fixed-day schedules will still be possible but we anticipate all borrowers will move to calendar schedules.

Voting

Yes: Implement all the features outlined in this proposal

No: Do not implement the features outlined in this proposal